|

401k Plan Loans - An Overview

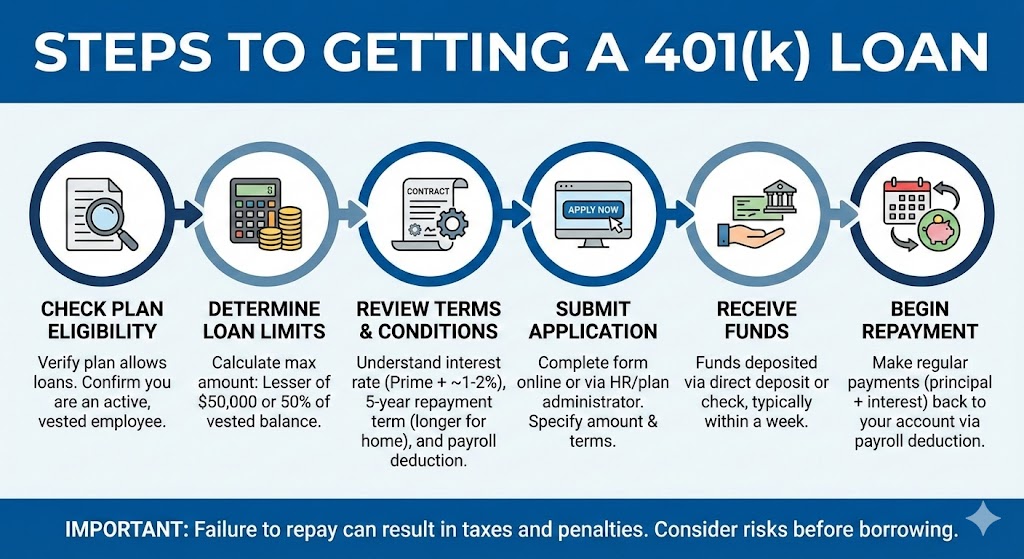

Allowing loans within a 401k plan is allowed by law, but an employer is not required to do so. Many small business just can't afford the high cost of adding this feature to their plan. Even so, loans are a feature of most 401k plans. If offered, an employer must adhere to some very strict and detailed guidelines on making and administering them. The statutes governing plan loans place no specific restrictions on what the need or use will be for loans, except that the loans must be reasonably available to all participants. But an employer can restrict the reasons for loans. Many only allow them for the following reasons: (1) to pay education expenses for yourself, spouse, or child; (2) to prevent eviction from your home; (3) to pay un-reimbursed medical expenses; or (4) to buy a first-time residence. The loan must be paid back over five years, although this can be extended for a home purchase. If a participant has had no other plan loan in the 12 month period ending on the day before you apply for a loan, they are usually allowed to borrow up to 50% of their vested account balance to a maximum of $50,000*. If the participant had another plan loan in the last 12 month period, they will be limited to 50% of their vested account balance, or $50,000, minus the outstanding loan balance in the preceding 12-month period, whichever is less. Because of the cost, many plans will also set a minimum amount (often $1,000) and restrict the number of loans any participant may have outstanding at any one time. Loan payments are generally be deducted from payroll checks and, if the participant is married, they may need their spouse to consent to the loan. While interest rates vary by plan, the rate most often used is what is termed the "prime rate" plus one percent. The current "prime rate" can be found in the business section of your local newspaper or the Wall Street Journal. Funds obtained from a loan are not subject to income tax or the 10% early withdrawal penalty (unless the loan defaults). If the participant should terminate employment, often any unpaid loan will be distributed to them as income. The amount will then be subject to income tax and may also be subject to 10% withdrawal penalty.** A loan can't be rolled over to an IRA. Just because you can obtain a loan from your plan doesn't mean it is always the best idea. So before sticking your hand in the cookie jar, you should consider the "pros and cons," some of which may surprise you. And remember, the purpose of a 401k plan is to fund your retirement, so don't shortchange your golden years by treating it as a checking account. The Pros:

* Notwithstanding this rule, a minimum of $10,000 may be borrowed (provided that there is adequate outside security for such a loan) -- IRC §72(p). ** Prior to the passage of the Tax Cuts and Jobs Act of 2017, participants who had left employment with an outstanding loan were expected to pay off the balance within 60 days of separation or face a 10% withdrawal penalty and have the distribution be considered taxable income. The Tax Cuts and Jobs Act of 2017 provides a greater repayment window, as individuals now have until the filing deadline of their individual tax return to avoid the tax consequences of a deemed distribution of an outstanding plan loan. (More...) Page 1 of 2 NEXT > The information provided here is intended to help you understand the general issue and does not constitute any tax, investment or legal advice. Consult your financial, tax or legal advisor regarding your own unique situation and your company's benefits representative for rules specific to your plan. |

|

About | Glossary | Privacy Policy | Terms of Use | Contact Us

|