|

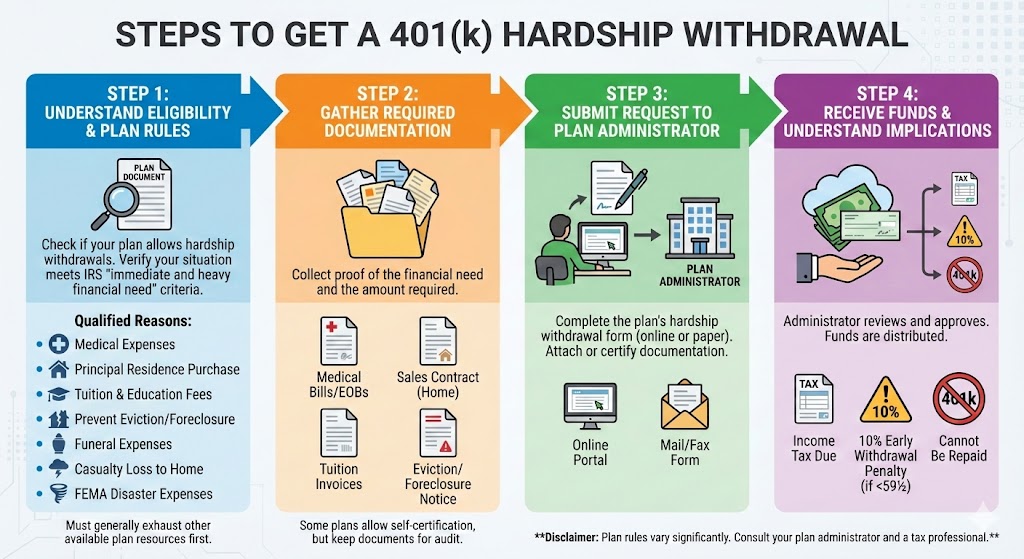

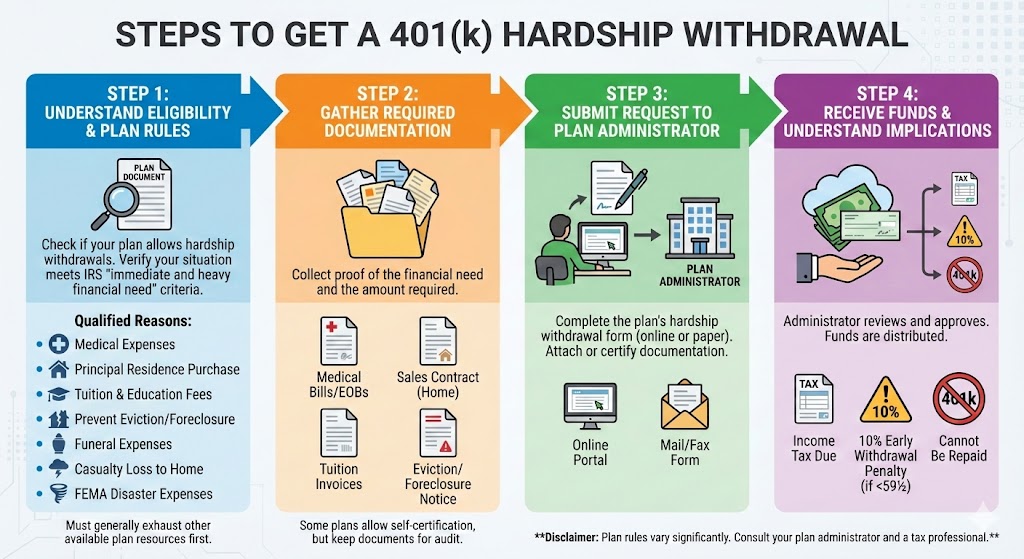

401k Hardship Withdrawals - An Overview

A 401k hardship withdrawal is an option for participants facing significant financial needs, allowing them to withdraw funds from their retirement account before reaching the age of 59½ without incurring the standard 10% early withdrawal penalty, under certain conditions. Here's an overview.

What Qualifies as a Hardship

The IRS recognizes several specific situations that may qualify for a hardship withdrawal:

- Medical expenses that exceed 7.5% of your adjusted gross income.

- Costs directly related to the purchase of a primary residence.

- Tuition and educational fees for you, your spouse, children, or dependents.

- Payments necessary to prevent eviction from your home.

- Funeral or burial expenses for a family member.

- Expenses for repairs of damage to the employee's principal residence that would qualify for a casualty deduction.

Important Considerations

- You can only withdraw the amount necessary to cover the immediate, urgent financial need.

- You must have exhausted other financial resources before taking the withdrawal.

- Hardship withdrawals are subject to income tax.

- If you're under 59½, you'll typically incur a 10% early withdrawal penalty.

- The withdrawal is limited to the amount of your own contributions (not including employer matches or earnings).

Financial Implications

- The withdrawn amount is taxed as ordinary income.

- It reduces your retirement savings permanently.

- You cannot replace the withdrawn funds beyond normal annual contribution limits.

- The withdrawal cannot exceed the amount of your actual financial need.

Restrictions

- Most 401k plans require documentation proving the hardship.

- Some plans may restrict your ability to contribute to the 401k for a period after the withdrawal.

- Not all 401k plans allow hardship withdrawals, so check with your plan administrator.

Alternatives to Consider

- 401k loan (if available).

- Personal loans.

- Emergency savings fund.

- Payment plans for expenses.

Recommendations

- Use hardship withdrawals as an absolute last resort.

- Try to explore all other financial options first.

- Consult with a financial advisor to understand the full impact.

- If possible, avoid withdrawing more than absolutely necessary.

Tax Reporting

- You'll receive a Form 1099-R reporting the withdrawal.

- You must report the withdrawal on your annual tax return.

- The withdrawal will increase your taxable income for the year.

Final Advice

Each 401k plan has its own specific rules, so it's crucial to:

- Speak directly with your plan administrator.

- Understand the specific terms of your retirement plan.

- Carefully consider the long-term financial consequences.

Remember: A hardship withdrawal can significantly impact your retirement savings, so it should only be used in genuine financial emergencies when no other options are available.

The information provided here is intended to help you understand the general issue and does not constitute any tax, investment or legal advice. Consult your financial, tax or legal advisor regarding your own unique situation and your company's benefits representative for rules specific to your plan.

|