|

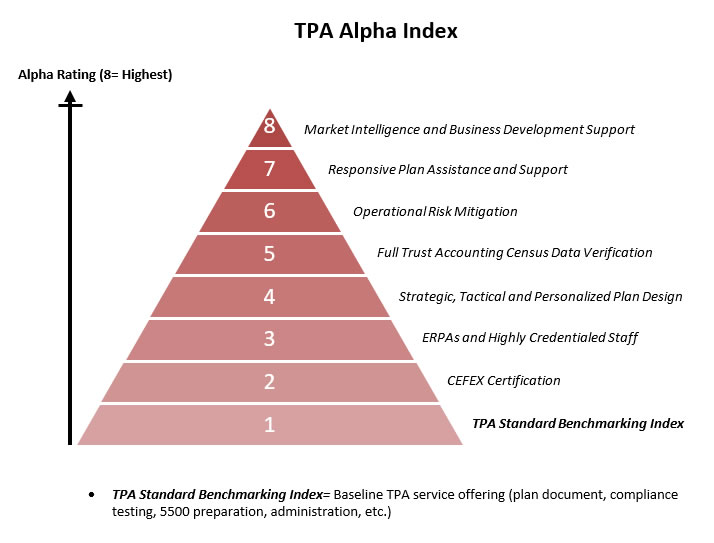

Guest Article TPA Alpha: A New Approach to Evaluating TPAsBy Jason Brown APR®, CBC® and Patrick Shelton, GBA® Over the years, we have spent a lot of time discussing the differences between average retirement plan third party administration firms (TPAs) and those that provide superior quality and capabilities for plan sponsors. However, circumstances still exist where retirement plan advisors put the fee structure of two (or more) competing TPAs on a spreadsheet and make the decision on which firm to engage based primarily on cost. We find this process somewhat vexing, as advisors typically spend an inordinate amount of time screening mutual fund performance to justify value (performance vs. cost), but do not incorporate a similar thought process when evaluating administration service providers. What if TPAs were evaluated for value and performance in a similar manner as mutual funds? If so, determining a TPA's "Alpha" potential could be a great place to start. What is Alpha? Alpha is the rate of return that exceeds what was expected or predicted. Alpha should be utilized as it is one of the most prominent and applied metrics in evaluating a mutual fund's performance and can be correlated to the TPA market. Determining Alpha is important because it provides a tangible measurement that helps substantiate the performance Retirement plan advisors and plan fiduciaries have not yet incorporated a similar concept as Alpha to review and validate the selection of TPA firms. Much like investment managers, there are TPAs that underperform the market and deliver negative Alpha; some that are level with the market and deliver no Alpha; and other quality TPA firms that outperform the market with regard to services and capabilities that can deliver positive Alpha. If a similar premise was utilized in selecting TPAs, then the firm that has the highest probability of delivering positive Alpha would be the most obvious and prudent choice. How can this evaluation be conducted? To create an Alpha validation process, a TPA Benchmark Index must first be established to determine what features and services are typically offered within the universe of TPA firms and what is to be expected. Once the index is established, it can be utilized as a baseline for evaluating additional capabilities that a TPA may offer. Listed below are services that are typically performed by the "TPA market" (independent from record-keepers). Please keep in mind that not all TPAs perform these functions at the same level, but these are considered standard services. We will use the components below to establish the Benchmark Index for the Alpha creation comparison:

Next, it is necessary to determine additional services and capabilities that could help mitigate fiduciary risk, support retirement plan advisors, and increase the proficiency of a retirement plan above and beyond the "TPA Benchmark Index," thus, enhancing the opportunity for a TPA to deliver Alpha. Each item listed below would offer an incremental increase above the Benchmark Index and potential Alpha creation:

Once this comparison is completed it simply becomes a question of whether or not the retirement plan advisor and plan sponsor want to engage a firm that offers mediocre tools and services in relation to what the plan sponsor needs (the TPA Index), or one that has the ability to deliver Alpha. If given the choice (much like the investment selection process) plan sponsors are going to take Alpha every time! Remember, cost is what you pay for, but value is what you get. Make sure your TPA of choice has the capability of delivering Alpha for you and your clients! Jason Brown is a Principal with Benefit Plans Plus, LLC. He has more than 15 years of retirement plan industry experience as a Financial Advisor, Business Development Director, Qualified Retirement Plan Strategist, Retirement Plan Advisor, and Trust Administrator. Patrick Shelton is Benefit Plans Plus's Managing Member and has more than 25 years of retirement plan industry experience in banking/trust, insurance, and third party administrative environments. He is responsible for innovating and executing the firm's business plan. Additionally, he specializes in financial advisor relations, including 401k sales prospecting presentations, vendor searches, and fiduciary consulting. ### 401khelpcenter.com is not affiliated with the author of this article nor responsible for its content. The opinions expressed here are those of the author and do not necessarily reflect the positions of 401khelpcenter.com. This article is for informational and educational purposes only and doesn't constitute legal, tax or investment advise. |

|

About

| Glossary

| Privacy Policy

| Terms of Use

| Contact Us

|

of a mutual fund relative to risk, which in turn supports the value that a fund manager is creating when compared to the Index Benchmark. The overall objective is to validate if the investment manager is providing a higher level of skill in selecting the mutual fund's portfolio than other money managers in his category.

of a mutual fund relative to risk, which in turn supports the value that a fund manager is creating when compared to the Index Benchmark. The overall objective is to validate if the investment manager is providing a higher level of skill in selecting the mutual fund's portfolio than other money managers in his category.